With the blogosphere breathless about Scott Walker’s “plan” to eliminate automatic increases in the gas tax, I thought I would add a little of my own perspective (it appears Owen may have passed out at his keyboard absorbing the “genius” of the plan). In order to make it more readable, I will add Mcbridean bold face to key terms.

With the blogosphere breathless about Scott Walker’s “plan” to eliminate automatic increases in the gas tax, I thought I would add a little of my own perspective (it appears Owen may have passed out at his keyboard absorbing the “genius” of the plan). In order to make it more readable, I will add Mcbridean bold face to key terms.

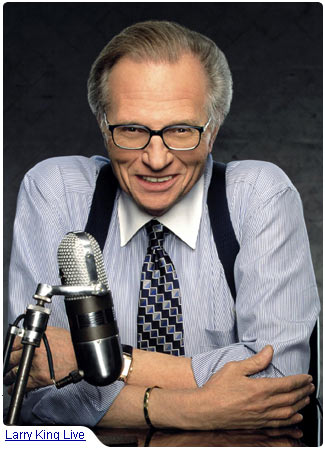

I also heard a rumor that Larry King would return to writing his column for USA Today. I grew up reading his column, and revered it. So I will also write this post as if it were Larry King’s unintentionally funny USA Today column, with barely relevant, semi-lucid non-sequiturs and random thoughts.

* As everyone in the blogosphere has heard, candidate for Governor Scott Walker announced a plan that would eliminate indexing of the gas tax, earmark funds from vehicle related sales for the transportation fund, and protect the transportation fund from future raids. Apparently some bloggers are upset that local news didn’t break into “According to Jim” to report this groundbreaking news. Actually, this “plan” is the exact plan that State Senator Tom Reynolds introduced in the form of Senate Bills 330 and 331 back in September. Walker may have heard that Reynolds’ plan was gaining traction and decided to get out in front of it to take credit if it happens, but it is by no means his original plan. In fact, both Walker and his primary opponent, Congressman Mark Green, are likely to have taken interesting votes on this issue during their tenure in the Legislature (Xoff is reporting that Walker voted against what he is proposing now, but I need citations to figure out what the exact vote was).

*When midgets and dwarves get married, is it considered a “mixed marriage?”

*Proponents of the plan argue that there shouldn’t be any tax that goes up automatically every year. Fair enough. But in raw dollars, every tax automatically goes up every year, because most other taxes are figured on a percentage basis. For instance, the state always collects more from the sales tax because inflation pushes the price of goods and services upward, and five percent of that cost goes to the state. In most years state incomes increase but the tax rate remains the same, meaning the state collects more in income taxes without “raising” taxes at all.

The gas tax is different, in that it is a flat 31 cent fee on every gallon of gas, and is not figured as a percentage. There is a legitimate reason for assessing this tax differently. Since gas taxes are dedicated to a single purpose (road construction), it would cause havoc with the state transportation fund given the mercurial price of gas. If gas were taxed on a percentage basis, there would be no way to project how much would be in the fund for road construction in any given year. While prices of other goods and services fluctuate, the tax collected on them gets dumped into the enormous general fund and pays for an array of government programs, so it tends to even out. Assessing the gas tax as a flat fee allows state government some certainty in what projects they go ahead with.

Following the logic of the gas tax indexing opponents, you could say the gas tax actually goes down when gas prices hit $3.00 per gallon, since the percentage tax per gallon actually shrinks with the higher cost of gas and stagnant tax. So you see, the indexing of gas taxes is merely meant to reflect what happens to every other sales tax in the state, just assessed differently. (For information about the state sales tax, check this document out – you can see on page 14 that sales tax collections have grown from about $2.4 billion a decade ago to $3.9 billion in 2003-04, without a change in the rate.)

*For NBA purposes, do Europeans count as white people? If they do, do I have to start rooting for Dirk Nowitzki?

*Obviously, eliminating the automatic increase in the gas tax is the sexiest and most important part of the plan. The other parts are merely talking points and are essentially meaningless. “Protecting the transportation fund” from raids sounds good, but it’s impossible without a constitutional amendment. Sure, the Legislature could pass a law prohibiting fund transfers out of the transportation fund, but absent a change to the state’s constitution, the next Governor could just introduce a future budget that repeals this “protection” and not take much of a political hit for it.

*Can the name Robin Williams be used in a sentence without the word “genius” in it? Like in the brilliant Patch Adams, when he puts on the fake nose to make the little kids with cancer laugh? What a great message – it says laughter is the best medicine, unless you happen to be dying of cancer.

*Earmarking sales taxes from a specific source is worthless given the point made above, plus the fact that it just steals money from the general fund, causing a deficit there that would likely be filled from another one-time source. In the end, there wouldn’t be much change to the status quo. And fine, go ahead and lobby the EPA to do away with reformulated gas requirement until you’re blue in the face. That strategy seems to have worked pretty well so far, hasn’t it?

*Earmarking sales taxes from a specific source is worthless given the point made above, plus the fact that it just steals money from the general fund, causing a deficit there that would likely be filled from another one-time source. In the end, there wouldn’t be much change to the status quo. And fine, go ahead and lobby the EPA to do away with reformulated gas requirement until you’re blue in the face. That strategy seems to have worked pretty well so far, hasn’t it?

*Ranch dressing! The utility infielder of condiments!

*Just because I raise these concerns, don’t think that I’m not in favor of this plan. I am. I think road projects for the most part are bloated, and are a prime source of government waste. Any government should have to work within the parameters of what the people can afford, and Wisconsin’s gas tax is excessive.

But if the Legislature were to go ahead with this plan, they need to fund it. The State’s road plan scheduled projects between 10 and 15 years ahead of time, and the transportation fund is already facing a shortfall for the projects they have already approved. Merely passing the Walker/Reynolds plan without making cuts to road projects is a little short of honest, as it would create a transportation fund hole.

*Pancakes! Are they the new waffles?

*Conservatism, as I understand it, means lower taxes and smaller government. The plan addresses the lower taxes part, but takes a pass on the smaller government aspect. Less money means scaling back the road building plan. Where is that going to happen? If the Legislature passes a bill that doesn’t make the cuts to fund the loss in revenue just to get a cheap political vote and get a lap dance from conservat

ive bloggers, it better be ready to increase the tax in the future or increase vehicle registration fees, which is the other way roads are funded.

*If I were arguing in favor of gas tax indexing (which I am not), I would point out that if there ever was something that could be considered “Republican spending,” it would be road building. New and improved roads generate economic development – think the state could get by without renovating the Marquette Interchange in Milwaukee? Is there any question that businesses would help revitalize the north side of Milwaukee if there were a northern highway similar to I-894 to the south? Instead, all the north side malls are rotting and businesses are fleeing en masse. There’s a reason this plan is usually proposed by Democrats – it would substantially curtail road building, which placates the environmental left wing.

*We can clone dogs but we can’t make a pair of adult diapers that don’t make me look like I dropped a couple egg rolls in my shorts?

*One final note: It’s fine to believe legislators are in the pocket of this special interest group or that. Cynicism is healthy. But it’s a charge that is often thrown around without any facts, and is a cheap political trick generally used by liberals. It would be a shame to see conservatives resort to this type of trashing without evidence against fellow conservatives. If you have names, dates, and contributions that you can tie to specific legislation or legislative action, by all means make that connection known. Disclosure laws already exist that shed the light on most contributions, which is in stark contrast to the old days when state contracts could have been sold to the highest bidder and nobody would ever know. But generally decrying the influence of money in government only leads to more heavy handed regulation of political speech, and we’ve seen how convoluted that can be.

Leave a Reply